Conventional Loans

Have you heard of Fannie Mae or Freddie Mac? These are the companies that provide conventional home loans. If your credit score is in good shape, you'll only need to put 3% down on your new home.

Happy New Year! We hope that 2022 is off to a fantastic start for you and your family. Do you have plans to buy a new home this year? If so, you're probably thinking and saving for a down payment, but how much do you need? There are many loan options, and you may not need 20%.

Have you heard of Fannie Mae or Freddie Mac? These are the companies that provide conventional home loans. If your credit score is in good shape, you'll only need to put 3% down on your new home.

Are you a first-time homebuyer? Then, an FHA loan might be a good option for you. Generally, you could put as little as 3.5% down.

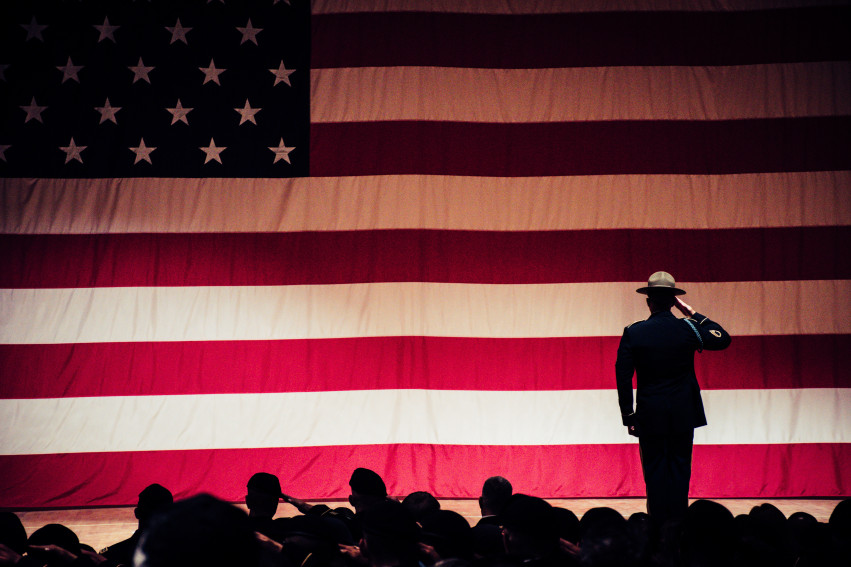

If you're a veteran or currently active military, your service is appreciated. Getting a VA loan doesn't require a down payment.

USDA Loans are backed by The US Department of Agriculture's Rural Development Program. These loans are for rural and suburban homebuyers. Check with your lender for income and loan requirements if you feel this is the right loan for you.

That's just a brief idea of the loans that allow you to save a little cash upfront. Of course, a mortgage professional will help you find the best option for you. I work with incredible lenders that can help. If you're ready, give me a call, text, or reply to this email. I'd be happy to help you with your move.

Call us:

936-291-1520

Email us:

“They are one of a kind! If you're looking to sell your home or buy your dream home and want to leave the details to the experts, this team is for you!”

We'll get in touch with you soon.